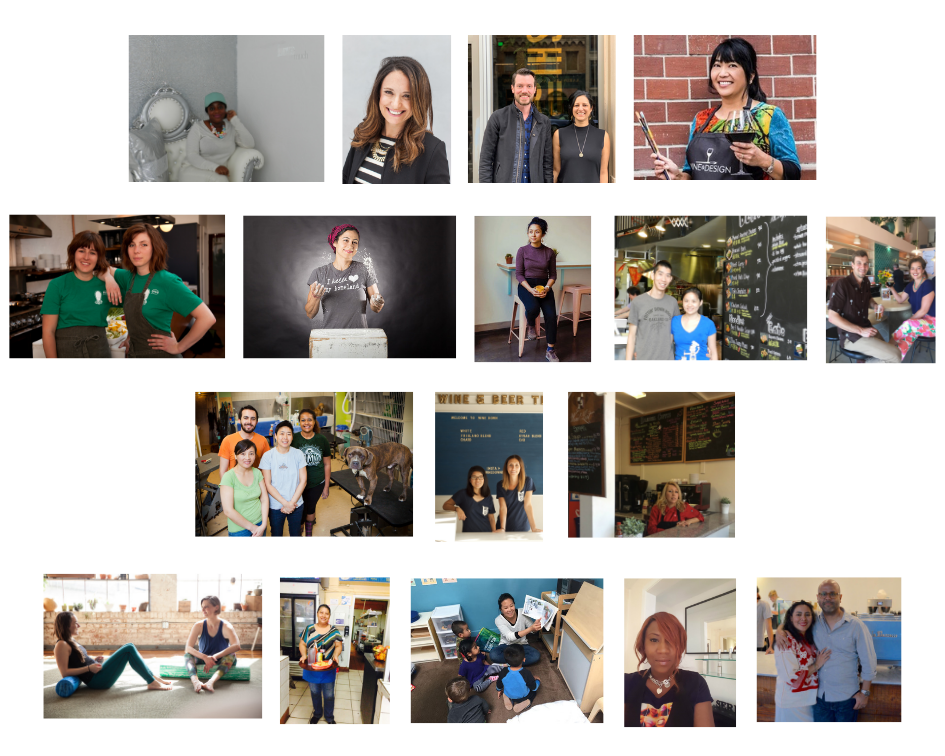

It’s Women’s History Month, and we look forward to celebrating the impact of women entrepreneurs. In this post, we share some basic statistics about women-owned businesses and ways to support women entrepreneurs.

The most recently available statistics come from the 2018 State of Women-Owned Business Report by American Express, and SCORE’s Megaphone of Main Street: Women’s Entrepreneurship, Spring 2018 report. Both studies underscore the strides made and persistent barriers faced by female entrepreneurs. A more extensive compilation of key information from these reports can be found here.

Women own four out of ten businesses in the United States. This number has grown by 58% since 2007, outpacing 12% overall businesses growth. As of 2018, there are 12.3 million women-owned businesses in the U.S. Considering that in 1972, there were only 402,000 women-owned businesses, representing just 4.6% of all firms, this represents significant progress.

Much of this growth is driven by women of color. In 2018, women of color account for 47% of all women-owned businesses. Businesses owned by women of color grew by 163% between 2007 and 2018. Most of these women are driven to entrepreneurship by necessity rather than opportunity. The SCORE report says, “From 2007 to 2018, higher unemployment rates, long term unemployment, and a much greater gender and racial pay gap led women of color to start businesses at a higher rate in order to survive, rather than to seize a market opportunity.”

Furthermore, the share of revenue and workforce of women-owned business compared to overall businesses is not keeping up. From 2007 to 2018, total employment share increased from 6% to 8%, while revenue share increased from 4% to 4.3%. Currently 88% of women-owned businesses generate less than $100,000 in revenue. This group of very small businesses is growing at a rate that is faster than the growth rate for larger women-owned companies. Just 1.7% of women-owned businesses generated more than $1 million in revenue; these firms represent 68% of total employment for all women-owned businesses and 69% of total revenues. Half of women-owned businesses are concentrated in three industries: other services, health care and social assistance, and professional/scientific/technical services. Such findings support the notion that most women start businesses as a way to create a job for themselves out of necessity, or create a higher quality job for themselves than they could find in the general job market.

Women typically start with less business financing than their male counterparts and are less likely to pursue it. Only 25% of women are likely seek financing for their business, compared with 34% of men. Women typically start with small loans (less than $50,000) while companies started by men tend to have closer to $1 million in investment. Women remain deeply underrepresented in venture capital investment at only 9%. We also know that businesses that start with more capital grow faster and have the ability to take risks because they have the funding available to survive challenging periods. By supporting women-owned businesses with capital, funders expand the abilities of women-owned businesses to have a broader economic impact. This is one of the many reasons we are proud to support so many women-owned companies with the money they need to start and grow their businesses.

This March, we encourage you to shop local with women-owned businesses. We’ll share some of our favorites on social media (follow us @mainstlaunch), and please share your favorites with us!