Paula Groves is OBDC’s Vice President – Business Consulting. This is part of her ongoing series of best practices and tips for small business owners. Never miss a tip by signing up for our newsletter.

By now most small businesses are aware of the new minimum wage laws that are being implemented in Oakland and San Francisco. Here’s a quick recap:

- Oakland voted with an 80% majority to raise its minimum wage from $9 to $12.25 starting in March 2015 (more info: oaklandnet.com/MinimumWage).

- San Francisco voted by an over 75% majority to raise the minimum wage to $15 an hour by 2018 (more info: http://sfgsa.org/index.aspx?page=411)

Now many are restaurants trying to determine how best to implement the new wage structure while still growing a profitable restaurant. An initial first reaction is to raise prices, but as noted in the East Bay Express feature story “The Tipping Point” by Luke Tsai, it is not that simple. A price increase needs to take into account several factors such as:

- How expensive is your food now?

- Can your customers pay for higher prices?

- Are your competitors raising their prices?

Diving a bit deeper into the numbers reveals that restaurants may have other options besides raising their prices 36%, the same percentage as the minimum wage increase, which could be a bit much for customers to swallow. A few tips include:

- Determine what percentage of your costs are actually payroll for minimum wage employees. When taking into account things like rent, utilities, food and drink and overhead costs, one client found that the minimum wage cost was only 15% of the total. Therefore, they can raise prices by an amount significantly less than 36% and still remain profitable.

- Use this new measure as a motivator to do a financial analysis and see if your costs are in-line with industry standard. You may discover other areas where you can cut back. Can you reduce food waste? Can you purchase food supplies for a lower price? Can you get your landlord to reduce rent by a few bucks each month?

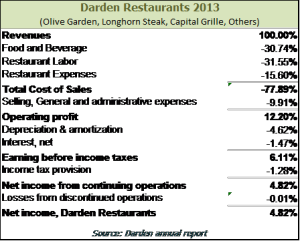

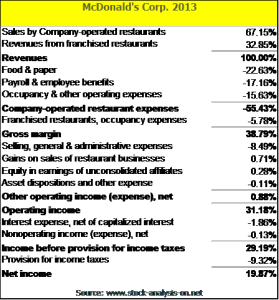

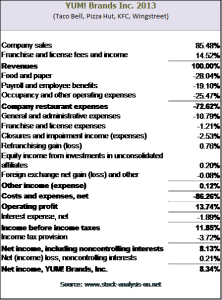

One way to determine whether or not you are overspending on certain costs is to create a “common size income statement” and compare it others in your industry. A common size statement takes each cost category and divides it by total revenue. Do you know if your labor costs are in-line with others in your industry? Below are common size statements for four food companies. Note what their labor costs are:

- Darden Restaurants (including Olive Garden, Longhorn Steakhouse, Capital Grill and other restaurants) shows a labor cost of 31.5% of revenue.

- McDonalds shows a labor cost of 17.16% of revenue.

- Yum Brands (including Taco Bell, Pizza Hut, KFC, and Wingstreet) shows a labor cost of 19.1% of revenue.

While small businesses are a bit different, these statements provide some insight into what others are spending on costs. Create your own common size statement and compare it to the ones below to see if you might be overspending in some areas. Contact Paula@OBDC.com if you want to do a financial analysis of your cost structure.