Main Street Launch’s Intern – Impact Evaluation & Marketing Linda Ho offers information about CDFIs. This article was originally posted on January 10, 2018.

WHAT IS CDFI?

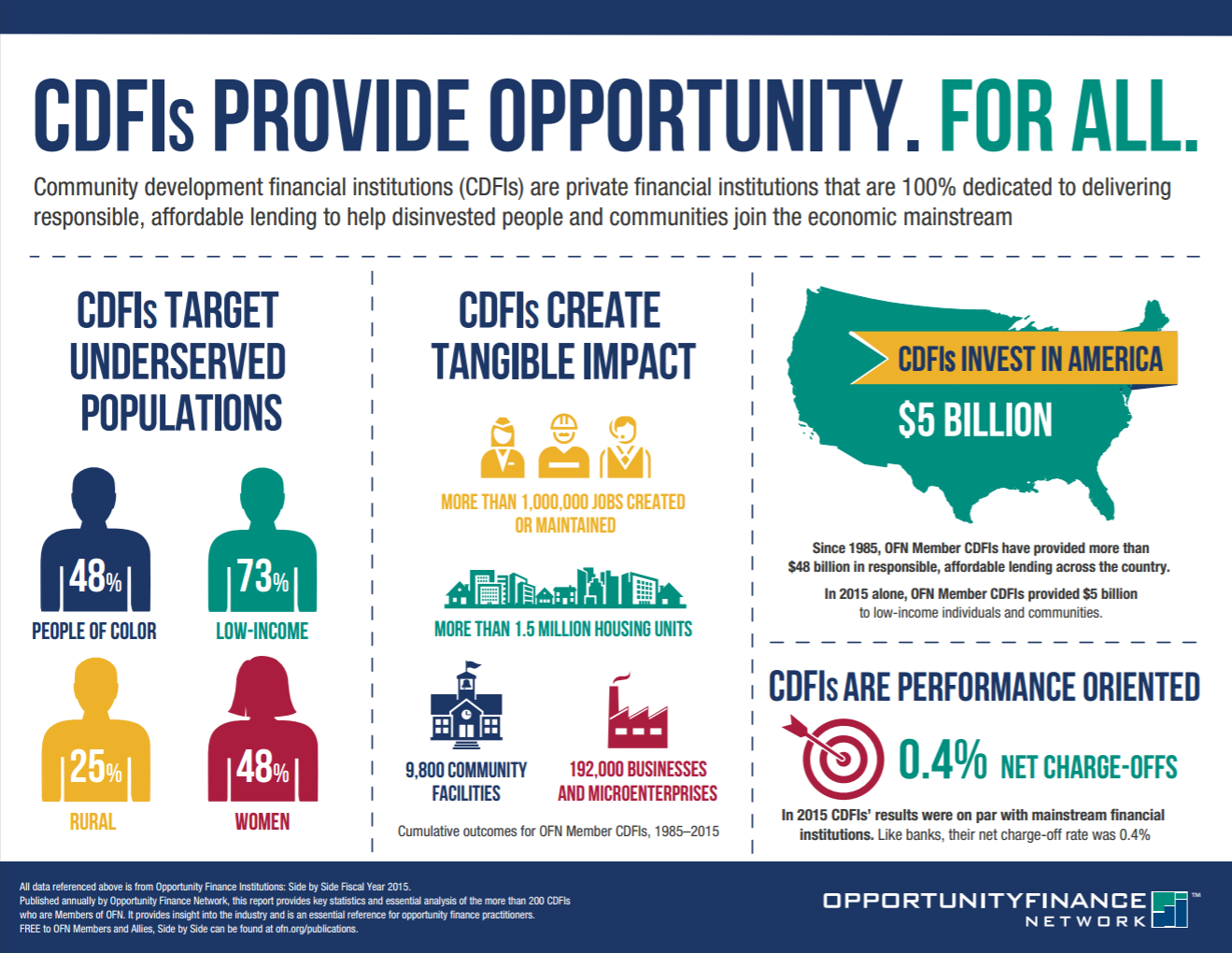

Community Development Financial Institutions (CDFIs) provide access to financial services for local residents and businesses, sharing a common goal of expanding economic opportunity in low income communities.

CDFIs can be banks, credit unions, loan funds, microloan funds, or venture capital providers. CDFIs are helping families finance their first homes, supporting community residents starting businesses, and investing in local health centers, schools, or community centers. Click here for more information about CDFIs.

HOW DID CDFIs BEGIN?

To support the emerging community development financial institutions, the Community Development Financial Institutions Fund, or CDFI Fund, was established by the Riegle Community Development and Regulatory Improvement Act of 1994. Since then, CDFIs have been providing important services in rural, urban, and suburban communities across the United States.

CDFIs – BY THE NUMBERS

Click here to learn more about the impact of CDFIs across the country. Some notable metrics are:

- 926 CDFIs, including 73 Native CDFIs, have been certified to work in low-wealth communities across the country;

- The list of institutions certified as CDFIs includes 504 loan funds, 242 credit unions, 162 bank holding companies, banks or thrifts, and 14 venture capital funds, located in rural and urban areas in all 50 states as well as the District of Columbia, Puerto Rico, and Guam.

- Since 1994, the CDFI Fund has awarded more than $2 billion on a competitive basis to CDFIs including Native CDFIs, small and emerging CDFIs and financial institutions through the TA, FA, BEA, and NACA Programs

- In FY 2014, CDFIs made over 28,000 loans or investments totaling nearly $3 billion, financed nearly 10,000 small businesses and over 25,000 housing units.

MAIN STREET LAUNCH, A CERTIFIED CDFI

Main Street Launch is proud to be a certified CDFI. Since 1979 we have empowered small business owners in the Bay Area, beginning in Oakland and expanding to serve San Francisco and veteran-owned businesses in California. Through our core services we help small businesses expand in size, increase their profits, and reach their goals. Click here to learn more about us and what we do.

GET CDFI SUPPORT

If you are looking for CDFI support for your small business, please visit: https://ofn.org/cdfi-locator

If you are looking to purchase a home and want to know if a CDFI can help, please visit: https://www.cdfifund.gov/programstraining/Programs/cmf/Pages/default.aspx

Tell us how CDFIs have helped you on Facebook!